Rachel Reeves’s first Budget will be on Wednesday 30 October and we have all been warned about the “difficult decisions” that she is bound to make.

The Chancellor’s ‘Public Spending: Inheritance’ speech to parliament at the end of July was designed to prepare taxpayers for changes to come.

To make sure the message was clear, she also revealed “A £22bn hole in the public finances now – not in the future.”

The new Chancellor took immediate action to start filling the hole, including cancellation of road and rail projects and ordering departments to stop all non-essential spending on consultants.

There were also two notable expenditure-saving measures:

- An immediate end to Winter Fuel Payments in England and Wales, other than for pensioners receiving certain means-tested benefits. (Scotland subsequently followed suit.)

- The abandonment of the scheme to cap care home fees in England, previously due to start in October 2025.

The next stage of strengthening the government’s finances will be unveiled in the Budget on 30 October. Even before Ms Reeves had discovered the £22 billion hole, think tanks such as the Institute for Fiscal Studies had forecast the first post-election Budget would see taxes rise – as they normally do.

The not so usual suspects?

So where might the Chancellor look for some much-needed cash? Her party’s manifesto said, “Labour will not increase taxes on working people, which is why we will not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT.”

However, as the previous government demonstrated, a ‘rates’ pledge leaves scope for creativity elsewhere, such as freezing or even reducing thresholds. In her July statement, the relevance of the manifesto’s reference to ‘working people’ was made clear by the surprising welfare cuts that primarily hit pensioners.

At present Reeves’s most likely targets appear to be:

National Insurance Contributions from employers

The Chancellor feels increasing employers NI contributions is in keeping with the manifesto promise not to increase NI. Taxing employers is, in her eyes, not a tax on working people and seems to feel, as Robert Peston succinctly puts it, that a rise in employers NI “would only hurt the owners of the business”.

She seems to ignore “that many employers would attempt to recoup this increased employment cost by limiting pay rises”. We will wait and see.

Capital gains tax (CGT)

The Labour manifesto made no mention of CGT. Several think tanks and the now defunct Office of Tax Simplification have floated the idea of bringing CGT rates in line with income tax, meaning that the maximum rate in most circumstances could rise from 20% (24% for residential property) to 45%.

Inheritance tax (IHT)

There are some obvious targets to add to Treasury receipts in this area. Business and Agricultural reliefs mean that the average effective tax rate on the largest estates is lower than that on more modest estates.

Scrapping those reliefs, or capping their value, would affect only a few estates, but could produce meaningful extra revenue. That said IHT is a much hated tax and tax revenues from it are steadily increasing.

So-called Baby Boomers and their parents are advancing in age and hold huge amounts of wealth in property and assets, so Reeves could simply sit and wait, further freezing allowances in the meantime.

Another exemption that could disappear – and affect many more people – is the current general exclusion of pension pots from IHT calculations.

Tax relief on pension contributions

Right now pension contributions attract income tax relief (within limits) at your marginal rate(s) of tax. That can be as high as 60% (67.5% in Scotland) in the income band where the personal allowance is tapered. Replacing the marginal rate relief with a flat rate relief is a commonly suggested reform.

If Reeves were to choose a 30% flat rate, clearly basic rate taxpayers would be better off, and the Exchequer would gain an estimated £3 billion a year. Higher Rate and Additional Rate taxpayers would lose out.

Tax free cash

There have been multiple references to Reeves considering a reduction in the tax free cash available to £100,000 (currently £268,275) and we have had more queries about this than any in recent weeks. Our view is as follows:

1. Historically, any changes that have resulted in a future reduction in pension benefits in some way have always been accompanied by protections.

2. If they do change the tax free cash amount – it is highly likely that clients’ existing benefits would be protected in some way.

3. Making panic changes in response to rumours and speculation is highly likely to produce a poor outcome -moving tax sheltered funds into the path of Income Tax, Capital Gains Tax and IHT- and could derail well planned financial strategies. “Act in haste, repent at leisure”.

4. Reductions in Tax Free Cash don’t just impact private pensions – it affects public sector pensions too and people from all walks of life have planned their futures taking that valuable benefit into account

5. It would affect confidence in pensions – and maintaining the nation’s preparedness to save for their retirement is hugely important. Pension savers could reasonably argue that they had saved on the understanding that they would be able to take 25% of their pension tax-free.

6. In the words of the IFS itself “Constant tinkering with pensions taxation is not welcome, though. Whatever package of reforms is pursued at the Budget, it is important to set out a clear and coherent direction of travel for pensions policy and, as far as possible, provide a predictable environment for savers.”

If you think any of these potential changes could affect you or you are considering other areas of tax planning, do seek financial advice as soon as possible.

The Financial Conduct Authority does not regulate tax advice. Tax treatment varies according to individual circumstances and is subject to change.

Interest rates take a step down

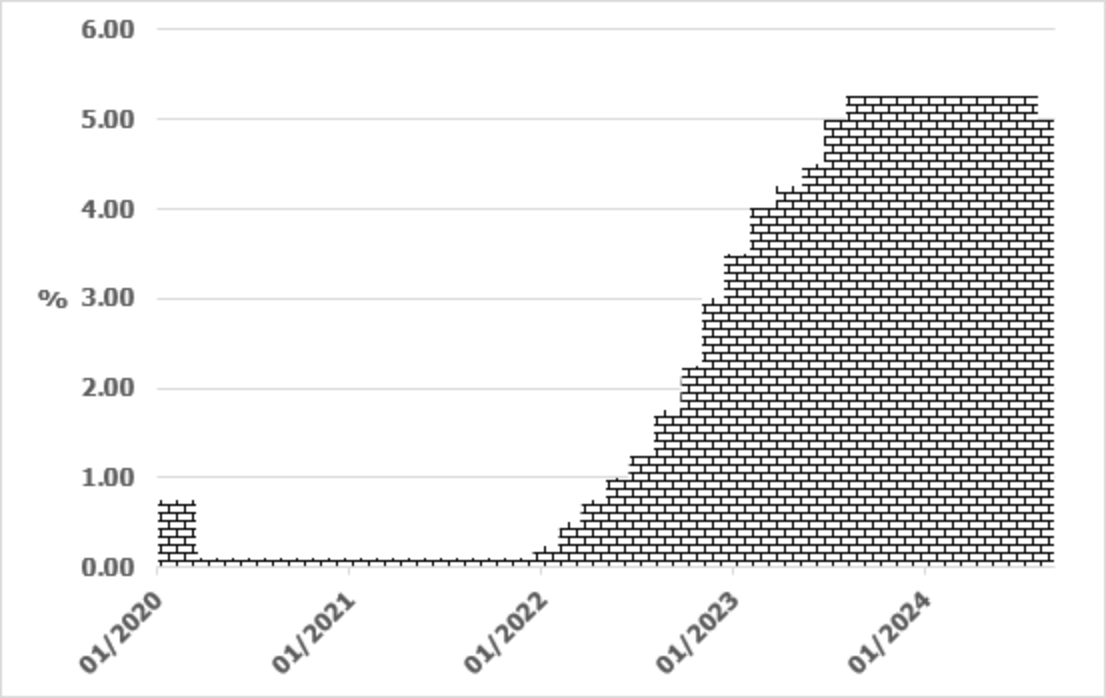

As the Bank of England cut interest rates for the first time in over four years, what are the implications for your investments?

Source: Bank of England

The Bank of England did something this summer unseen since 19 March 2020: it cut the Bank rate. The decision was a close call for the Bank’s Monetary Policy Committee (MPC): five voted for the reduction while four favoured holding rates unchanged.

However, that division reflected more a question of timing on the change rather than its direction.

After nearly a year with the Bank rate stuck at 5.25%, investors are now pondering two new questions: how fast will rates fall and how far? Unlike its counterpart in the United States, the Bank of England does not offer its own opinions on future rates.

Instead, the Bank prefers to produce its economic outlook using the future interest rates implied by the UK money markets. These currently suggest that the Bank rate will be 4.2% in the third quarter of 2025, 3.8% a year later and 3.5% by the third quarter of 2027.

Such numbers come with a health warning: unanticipated events can wreck the most carefully calibrated forecasts – as recent years have demonstrated.

Nevertheless, assuming no global pandemics, further wars or other international incidents, UK interest rates look set on a downward path, although a return to the near-zero rates of the 2010s is not on the radar according to those money market projections.

Those rates were a prolonged response to the 2008 global financial crisis (followed by Covid-19) and are already beginning to appear an historic aberration.

Impact of falling rates

The expected steady decline in interest rates has several consequences for investors, including:

- New investors will see the return on fixed interest securities such as government bonds fall. This move is already underway, as investors buy to lock in current returns. For example, the benchmark 10-year government bond was yielding over 4.5% in October 2023, whereas by mid-August 2024 its yield was under 4%.

- Falling long-term bond yields go alongside a drop in annuity rates. If you are thinking about fixing all or part of your retirement income, delay could prove costly.

- Returns on cash deposits will drop as the Bank rate falls. So far in 2024 it has been easy to find cash returns above the rate of inflation, discouraging investors from leaving the investment sidelines. Inertia is now a serious risk if you are sitting with cash. Wait too long before making your move into long-term assets and you could miss investment profits.

- Lower interest rates benefit companies, particularly smaller companies which tend to have higher borrowing. In the US, which is at a similar stage in the interest rate cycle, there have been signs that investors are switching their attention from the mega companies towards smaller companies.

For advice on how you should approach an investment landscape of falling interest rates, talk to us soon – the longer you defer, the lower rates could drop.

Investments do not offer the same level of capital security as deposit accounts.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Joining the boom in top-rate taxpayers?

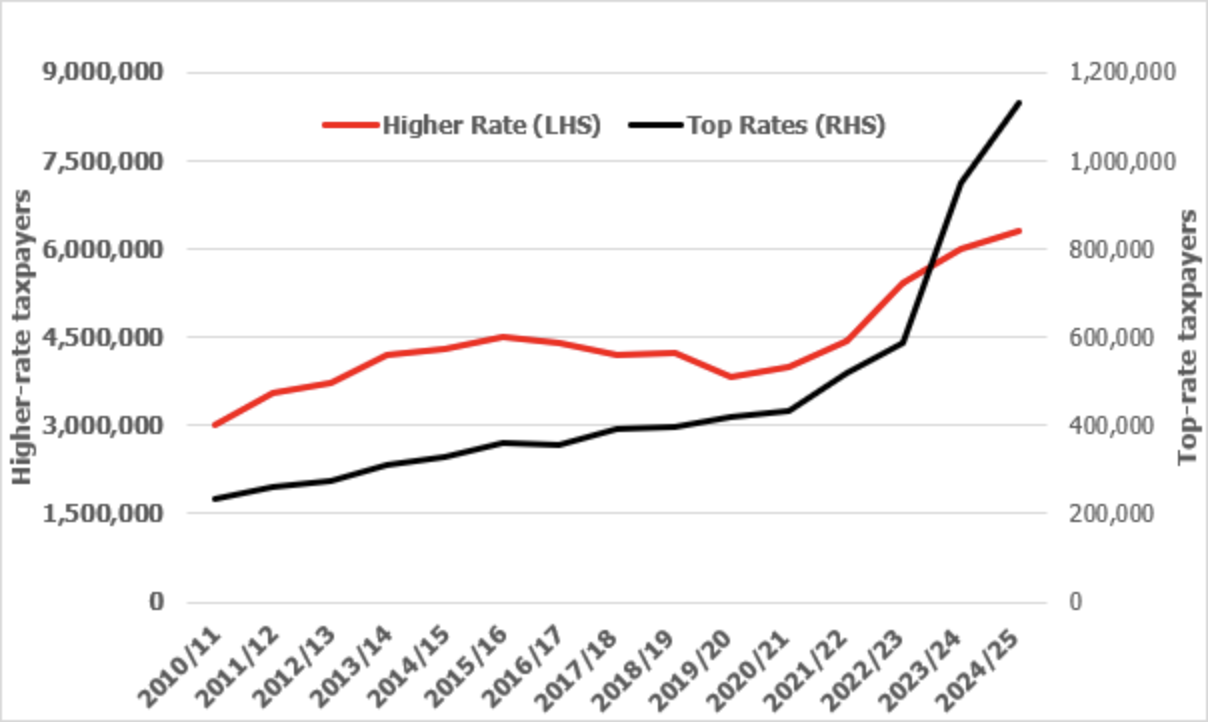

New data from HMRC show there are now more than a million people paying income tax at a rate of at least 45%.

Source: HMRC

Each year HMRC produces an extensive set of tables about income tax, the source of about 30% of all revenue flowing into the Exchequer. The stats that caught media attention show how many taxpayers are paying more than basic rate (see graph above).

Scotland complicated these tables several years ago by creating 19% and 21% rates alongside the 20% basic rate. In the current tax year, a further complication has been thrown into HMRC’s spreadsheets by the introduction of another Scottish tax rate, the 45% advanced rate.

This applies to taxable income (excluding dividend and savings income) between £62,430 and £125,140, the starting point for Scotland’s top rate (increased to 48% for 2024/25). The rest of the UK applies additional rate tax (at 45%) from the same upper level.

Faced with multiplying tax bands, HMRC decided that it would class anyone in the UK paying tax at 45% or more as an additional-rate taxpayer. This pragmatic approach had two consequences just about detectable on the graph above:

- The number of Scottish higher-rate (42%, not 40%) taxpayers fell 11% because some became advanced-rate payers.

- Scottish additional-rate taxpayers increased by 253%.

Hike in numbers

The Scottish distortions were not sufficient to alter two clear trends in the graph: a sharp rise since the start of this decade in the number of UK taxpayers who pay higher rate or additional rate (as HMRC defined) tax.

The boom in the higher-rate taxpayer population is a direct result of the freeze in the higher rate threshold at the 2021/22 level (throughout the UK), despite the 20%+ surge in inflation since April 2021.

The additional-rate tax story is worse because a £150,000 threshold freeze from 2010/11 was followed by a cut to £125,140 in 2023/24 (and the Scottish ‘advanced’ manoeuvre in the following tax year).

The higher-rate threshold freeze is currently due to end in April 2028, although it is possible that October’s Budget will extend the date – as previous Chancellors have found, threshold freezes are a useful stealth tax increase.

The additional rate threshold is fixed, with no prospect of change until a Chancellor decides to act. Suffice to say, such generosity to those with the highest incomes is not top of anyone’s political agenda.

At the time of the last Budget, the Office for Budget Responsibility estimated that by 2028/29 nearly one in five income taxpayers would be paying higher rate and more than one in thirty would be subject to additional rate.

If you find yourself in, or heading to, higher- or additional-rate tax, it is unlikely any Budget in the next few years will come to your assistance.

If the proportion of your income lost to tax in the future reduces, it is much more likely to be the result of careful personal tax planning than any Chancellor’s largesse. To find out more about the range of those planning options and the tax savings you could make, please get in touch.

The Financial Conduct Authority does not regulate tax advice. Tax treatment varies according to individual circumstances and is subject to change.

Dividends deliver – behind the headlines

UK companies paid their investors bumper dividends of £36.7bn in the second quarter of 2024 — an 11.2% year-on-year rise. Take a closer look behind the positive headline, however, and there are some important caveats.

Rising dividend payments can reflect economic growth and improved corporate profitability, so should be good news for investors. But analysis of the figures suggests investors should be cautious, as they include a significant jump in ‘special’ one-off dividends, made in exceptional circumstances.

In Q2, there were £4.1bn special dividends — including a whopping £3.1bn payment from HSBC following the sale of its Canadian subsidiary. Excluding these payments, regular dividends were up by just 1%.

Dividends aren’t just for income-seeking investors; they can, if reinvested, significantly boost overall returns. Over the last 20 years the FTSE 100 index has returned 65% to investors (or 2.6% a year.) But if this also includes reinvested dividends, total return is 239%, or 6.6% a year.

However not all companies pay regular dividends. These payments tend to be made by more mature, financially stable companies, or firms that can generate consistent cash flow. This might include utility companies, banks and oil and gas companies.

In contrast, less well-established companies, or those operating in rapidly evolving sectors, tend not to pay dividends. These firms may choose to reinvest profits into the business to drive further growth, rather than returning money to shareholders via a dividend.

In the UK almost 90% of the dividends paid are made by the largest listed companies that make up the FTSE 100, with banks making the strongest contribution to dividend growth during Q2. There was also strong growth in dividends from healthcare companies.

However, the figures also highlight where economic growth has stalled in recent years, with a significant drop in dividends paid by mining companies, and a fall in payouts from housebuilders.

In fact, if the relatively ‘weak’ mining sector is excluded from this year and last year’s figures, dividend growth across the rest of UK market stood at 8.6% — indicating that investors can still find income opportunities in the UK market, despite sector specific slowdowns.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The truth about student loans

Freshers starting university this autumn face higher costs for their education due to changes in student loan repayment rules in England. (Different rules apply in Scotland, Wales and Northern Ireland.)

Changes took effect last year, so don’t impact students who began degrees before September 2023. However, new students will experience significant differences in how they repay their loans compared to those who have just graduated.

The average student debt in England is £45,600, with some students owing £60,000, which covers both tuition fees (£9,250 a year except in Scotland) and means-tested maintenance loans.

However, student debt is unlike conventional loans because repayments are a fixed percentage of earnings, not tied to the total debt.

For instance, a graduate earning £30,000 annually will pay the same amount each month regardless of whether they have a student loan of £5,000 or £50,000. Unlike conventional loans, unpaid debts are written off after a set period.

The revised system has graduates repaying their loans once their earnings exceed £25,000, down from the previous threshold of £27,295. This means that a graduate earning £30,000 will now repay £450 annually, compared to £243.45 under the old system.

Additionally, the repayment period has been extended from 30 to 40 years, meaning some graduates could be repaying their loans into their 60s.

Higher earners are more likely to repay their debt within the original 30-year term, leaving those on lower and moderate incomes continuing to pay back for longer.

However, the government has revised how interest is calculated on these loans, capping the maximum interest rate at the Retail Price Index (RPI), a reduction from the previous cap of RPI plus three percentage points.

Regardless of the changes, focusing on paying down these debts doesn’t usually pay off, as it won’t reduce monthly repayment or necessarily ensure faster repayment.

Graduates, parents or grandparents are generally advised to focus financial help elsewhere. Even under the new terms, it is still estimated that 48% of graduates won’t pay off their debt within the 40-year period, with the loans eventually written off.

Ensuring green means green

Many of us are taking steps to tackle some of the big environmental challenges we face. This might be switching to an energy tariff that utilises solar and wind power, reducing plastic use or ensuring our money is invested sustainably.

There is now a wide range of ‘green’ investment products and funds, designed to appeal to the eight out of ten adults who say they would like to see their investments ‘do some good’ as well as deliver a financial return.

Until now, it has been difficult for ordinary investors to see whether the underlying investment strategy matches environmental claims, leading to industry concerns around ‘greenwashing’ — a term used to describe misleading advertising or marketing around, for example, sustainability-related claims.

Accurate marketing

The Financial Conduct Authority introduced a new anti-greenwashing rule from 31 May 2024 to tackle this problem. These clarified terms that related to sustainability, such as ‘green’, ‘responsible’ and so on.

A separate set of rules came in from July 2024 on product labelling and disclosure to help investors better understand how their money is being invested, aiding consumer choice.

Financial companies also now need to evidence relevant marketing claims, whether they relate to green credentials, sustainability or having a positive impact on the environment or wider society. This should enable regulators to act against firms who say one thing but do another when it comes to environmental and sustainability claims on funds.

Gaining trust

As a result, there may be fewer ‘green’ investment products on the market, but investors should have confidence that those remaining are proven sustainable investment options, that do what they say on the tin.

The value of an investment and the income from it could go down as well as up. The return at the end of the investment period is not guaranteed and you may get back less than you originally invested.

October tax deadlines approach

There are two other important tax dates in October, besides the Budget.

The final date for filing your 2023/24 tax return is 31 October 2024 if you do not want to file online (which has a 31 January 2025 deadline). These days, HMRC discourages paper tax returns and will only issue them on request. For 2022/23, over 97% of returns due were filed online.

New reporting

As the relevance of 31 October has faded, another October tax date has become more important – 5 October. This is the deadline for telling HMRC if you need to file a tax return and have not been sent one before.

For example, a return would be required if you started self-employment in 2023/24 with income exceeding £1,000 or realised capital gains above the annual exempt amount (£6,000 in 2023/24).

HMRC has an online tool that that allows you to check whether you need a return: https://www.gov.uk/check-if-you-need-tax-return

The Financial Conduct Authority does not regulate tax advice. Tax treatment varies according to individual circumstances and is subject to change.

News round up

VAT on school fees from January

Parents educating their children in the independent sector can expect a sharp rise in school fees from 1 January 2025, when the government will start imposing VAT at 20% on these fees.

Parents can’t avoid the increase by paying the full year’s fees early, as VAT will be applied to all payments for the January term made from the end of July this year.

The Financial Conduct Authority does not regulate tax advice. Tax treatment varies according to individual circumstances and is subject to change.

NS&I certificates

Lower inflation has made NS&I’s popular Index-linked Savings Certificates less attractive. Holders should weigh up options at maturity, rather than letting them roll-over into a new term.

Around 300,000 people hold these tax-free accounts, which pay an inflation-linked return for two, three or five years. Returns have been high in recent years, but with inflation expected to linger around the 2% mark there are now better paying accounts elsewhere.

Sterling’s high

Sterling has been one of the best-performing currencies in 2024. But a strong pound does not always help investors holding overseas funds and assets.

This is particularly true for Japan investors, with the Yen down against the pound by about 7% this year, negating some of the gains seen in the Japanese stock market for UK investors.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.